Things you should know before renting your first apartment

Renting your first home or apartment is both an exciting and overwhelming time!

Renting for the first time can come with many questions and concerns which is why we have put together a checklist before you sign your first lease.

When you are looking for a place to live there are some important factors to consider before you start your search. This includes your budget, what kind of rental you are looking for (condo, apartment, house, shared living space), what kind of neighbourhood you would like to live in and what kind of amenities you want. Each rental agreement will specify what is included in the monthly rent and what you are responsible for paying. Taking the time to thoroughly understand your lease is an important factor in setting yourself up for success when you are signing your first lease agreement!

What does the rental application process look like?

Each rental application may vary slightly, however, there are a few standard components to a rental application.

- Personal Information

A prospective rental housing provider will need your first and last name, phone number, email address, current address and a copy of your government-issued photo ID.

- Employment information and income information

- Personal or professional references:

- Credit Score

Be sure to spend some time learning your rights as a tenant before entering into any lease agreement!

Parts of a lease agreement

- Names of ALL the residents who are applying for the lease

- Duration of the lease

- What is included in monthly rent?

- Is the rental pet friendly?

This is important for anyone who is considering renting with a pet! Many rental housing providers will specify in the original rental posting whether pets are allowed; however, if you have or are considering getting a pet, it is important to ensure you have permission in writing.

Each province and territory have different regulations about tenant rights when it comes to having pets. For example, in Ontario, it is not permitted for rental housing providers to include a “no pet” clause in a rental agreement unless the rental is a condominium and the condominium corporation’s declaration prohibits pets (as specified by the Residential Tenancies Act).

Not each province has the same set of tenant rights, so always do your research in advance. It is also worth noting that although it may be legal to bring your pet into a new rental without permission, finding a rental housing provider who accepts pets willingly will make for a less stressful and all around more positive rental experience.

- What payment is due upon signing of the lease?

- How rent will be paid.

- Setting up renters’ insurance

*For more information about the benefits of Tenant Insurance, please see our blog post:

“Tenant Insurance: what your insurance company might not be telling you”

capreit.ca/tenant-insurance-you-have-more-coverage-than-you-think-blog//.

- 1. What is the monthly budget that I can afford?

- 2. What kind of neighbourhood would I like to live in?

- 3. What neighbourhood amenities am I looking for? (Schools, community centre, shopping, restaurants, public transportation, etc.)

- 4. What amenities are important to me? (Pool, gym, sauna, outdoor space, etc.)

- 5. Would I prefer to live in an apartment or condo or in a quieter space such as a walk-up apartment or a mobile home in a *land lease community?

- 6. Does the building allow pets; are there restrictions on pet size?

*For more information about the benefits of living in a land lease community, please see our blog post:

“What is Land Lease” capreit.ca/what-is-land-lease-blog/.

Answering these questions before you start your search will set you up to be successful in your apartment hunt! When you are signing your first rental agreement, knowledge is power. The more you are informed about your rights and your responsibilities as a tenant, the more confidently you will be able to handle this process for the first time! Use all the resources you have at your disposal, ask questions, and be prepared.

News

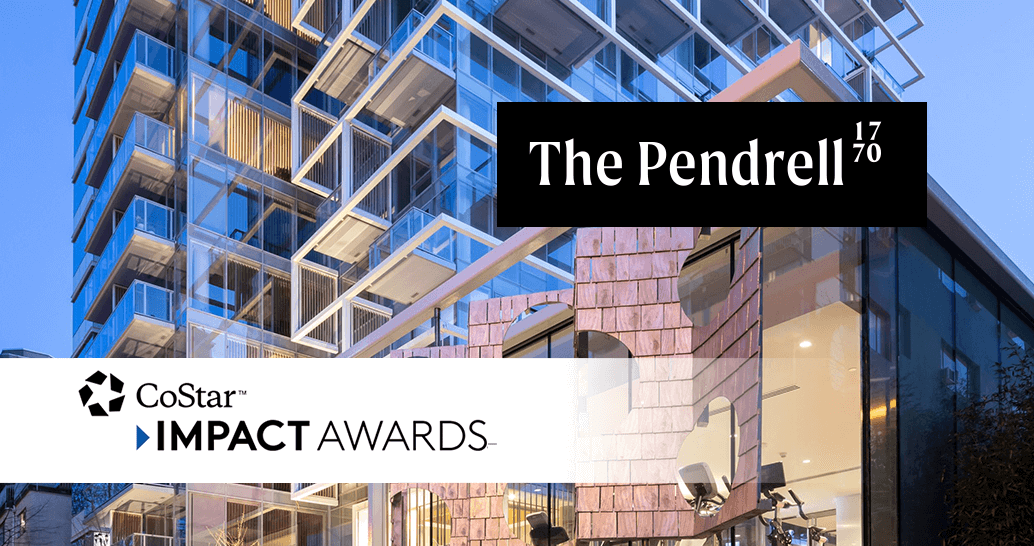

The Pendrell 1770 wins the CoStar Impact Award for Sale/Acquisition of the Year

Q&A with CAPREIT’s Julian Schonfeldt on the firm’s portfolio evolution

CAPREIT announces $194 million in new acquisition and disposition activity

CAPREIT Announces $104 Million Disposition in Montréal

CAPREIT announces $313 million of capital deployment in November