Some might call it good luck or timing that Canada’s largest publicly traded real estate investment trust was able to close a $137 million sale in less than a month.

According to Canadian Apartment Properties REIT Chief Investment Officer Julian Schonfeldt, closing such a sizable transaction required good teamwork, agility and disciplined deal execution by his team.

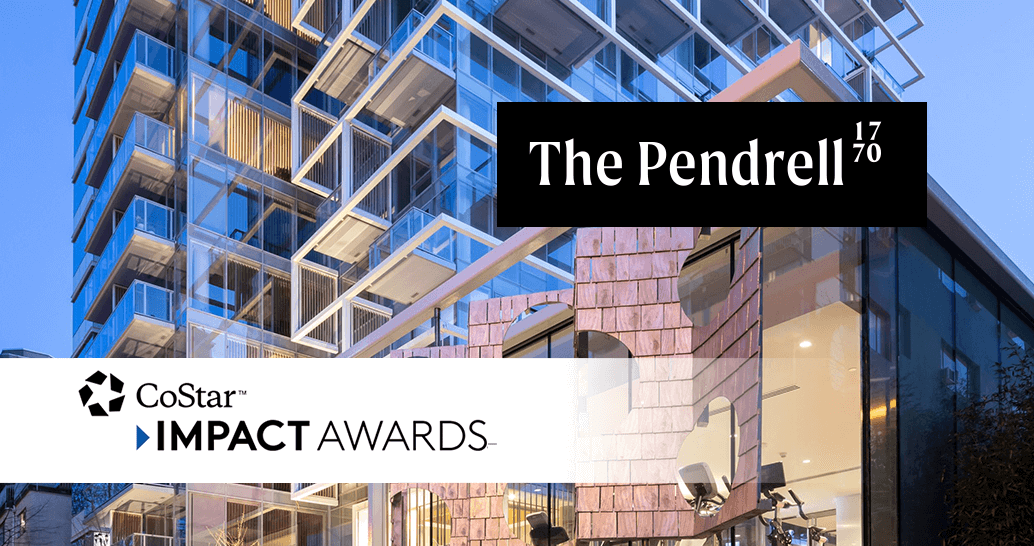

CAPREIT bought The Pendrell, a 21-storey, 173-unit luxury rental tower in downtown Vancouver, from locally-based developer Westbank last summer in a record 24 days — a deal that the Toronto-based trust called, “an extraordinary acquisition process.”

The REIT’s investment team fielded the first broker call on July 5, accepted the bid three days later and closed the sale on July 29 — a three-week period that’s just a fraction of the typical four to six months typically required to complete such big transactions, CAPREIT executives said.

The REIT assumed the existing $64 million mortgage at a favorable interest rate in a deal that the company said strengthens its portfolio and adds value for investors.

“Our ability to respond quickly and efficiently to this opportunity is a reflection of our team’s commitment to excellence,” Schonfeldt said. “We are proud to bring an unmatched level of agility and innovation to the acquisition process, ensuring that we can act on the best opportunities for growth and impact, no matter the timing.”

The smooth transition between various teams and — and help from the seller in maintaining contracts and providing support after the sale closed — ensured the transfer did not disrupt residents, CAPREIT said.

The efficiency and record speed of the transaction earned the deal a 2025 CoStar Impact Award for Sale/Acquisition of the Year, as judged by a panel of real estate professionals familiar with the market.

About the project: CAPREIT was attracted to The Pendrell’s design by Henriques Partners Architects and superior construction by Westbank, which the buyer said is known for its quality and attention to detail.

The tower is near natural attractions such as Stanley Park and Sunset Beach, and the rooftop terrace offers views of English Bay. Other resident perks include community gardens, a gym, yoga studio and Japanese garden.

What the judges said: The transaction “is an example of high-quality deal execution involving the purchase of a Class A asset in a very desirable Canadian submarket. It resulted in an excellent addition to an already impressive portfolio,” said Irfan Shariff of Hungerford Properties.

Finishing a deal so quickly “takes a lot of coordination and collaboration,” noted Liz Firer-Gillespie with Nicola Wealth Real Estate.

Closing the sale in “a very challenging capital markets environment” was a major accomplishment, added Matthew Hudson of Balfour Pacific Capital.

They made it happen:

CAPREIT Chief Investment Officer Julian Schonfeldt led the REIT’s deal team. Carey Buntain, a principal in Avison Young’s capital markets group, represented the buyer. Vancouver-based Premise Properties was the listing broker.